译者 塞上雪雪

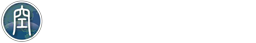

BEIJING — China imports rose sharply in October while export growth continued to slow, according to data released Thursday that suggest robust domestic demand could offset the effects of weakening demand for Chinese goods in Europe and elsewhere.

据周四发布的数据显示,中国十月份进口量增长迅速,而出口量增长持续放缓。这些数据表明,强劲的国内需求将会抵消欧洲等其它外国地区对中国货物需求量减少所带来的影响。

The stronger-than-expected import data may also reflect inventory buildups as Chinese importers took advantage of price swings to stock up on crude oil, copper and other commodities, analysts said.

分析师称,超出预期的进口数额同时也可能反映出中国进口商的囤货量增加,他们利用不同国家之间价格差异,加大原油、铜及其它原物料的存储量。

Over all, imports rose a surprising 28.7 percent, compared with levels a year ago, far surpassing an increase in September of 20.9 percent.

总的来说,十月份进口量增长速度极为惊人,同比增长28.7%,环比增长20.9%,远远超过了九月份进口量。

Export growth continued to moderate, rising 15.9 percent over levels of a year ago. Economists said the data — the weakest in eight months — reflected continued economic turmoil in Europe.

出口增长继续放缓,同比仅增长15.9%。经济学家称十月份出口增长速度是八个月来最缓慢的一次,这一数字表明了欧洲正处在水深火热的经济骚乱中。

Shipments to Europe grew 7.5 percent compared with the level of a year earlier, down from an increase of 9.8 percent in September, Barclays Capital said in a note.

巴克莱银行(Barclays Capital)指出,十月份向欧洲的发货量增幅同比仅增长7.5%,比九月份的9.8%的增长幅度明显降低。

Growth in exports to the United States rebounded, increasing 14 percent in October compared with the level of a year earlier, UBS Securities said in a note. Increases in exports to the United States in the previous few months had risen 10 percent to 11 percent, the investment house said.

瑞银证券在一次照会中指出,向美国出口量增幅有所反弹,十月份同比增长了14%。投资公司表示,在前几个月中出口美国总量增长了10%-11%。

While the import data were surprisingly strong, Yang Lingxiu, a Barclays Capital economist, said the export data were not alarming. “The external weakness will influence growth in China but it is not a great slowdown,” he said. “It is a moderation in momentum.”

巴莱克银行经济学家杨凌修指出,虽然进口总量大的让人惊讶,不过出口量也并不引人担忧。他说:“外部需求不足会影响中国经济发展,不过影响不会很大。内部需求和外部需求将会有一个对冲作用。”

Goldman Sachs said in a note that while exports were significantly down from the first half of the year, the data indicate “external demand has not deteriorated further” since July.

高盛投资公司在一次照面会上表示,上半年出口量骤减,现在这个出口量数据起码表明自7月份以来外部需求并没有继续恶化。

Chinese officials presented a more dire view. “What we’re facing now is a grave situation for exports and slowdown is inevitable in the third and fourth quarters,” Zhang Yansheng, director of the Institute for International Economics Research of the National Development and Reform Commission, said, according to a report by Xinhua, the state-run news agency.

据新华社消息,国家发改委对外经济研究所所长张燕生提出了一个更悲观的观点。他说:“我们现在的出口量处于一个非常困难的境遇,第三季度和第四季度出口量增速放缓是不可避免的。

Mr. Zhang, China’s top economic planner, attributed the moderation in economic growth to shrinking external demand, rising costs, liquidity problems and the gradual appreciation of the renminbi. He said that China also faced the risk of trade-protection measures in Europe and the United States, which says that China keeps its currency weak against the dollar to lower the price of its exports.

作为中国首席经济规划师,张燕生表示中国经济增长放缓归因于很多方面,包括外部需求日渐萎缩,成本逐渐增长,流动资产问题以及人民币逐渐增值。他还指出,欧洲、美国认为中国以较低的人民币汇率来降低中国出口产品的价格,因此在其国内实施贸易保护主义政策,这也是中国所面临的困难。

巴克莱银行称,今年中国出口总量预计将会增长20%,因此贸易顺差很可能会缩小为GDP的2.4%,比2010年的3.1%有所下降。中国官员用这逐渐减小的贸易顺差来证明中国经济越来越平衡,并且越来越多的依赖于国内工业和消费领域的需求。

UBS Securities said, “For now, the weakening exports, strong imports and narrowing trade surplus should help China resist calls for a faster appreciation” of the renminbi.

瑞银证券称,“现在,逐渐衰减的出口量,巨大的进口量以及逐渐缩小的贸易顺差都将会帮助中国更有力的拒绝那些让它加快人民币升值的要求”。

Data released Wednesday also suggested that inflation in China was easing, with prices rising 5.5 percent in October compared with levels a year earlier. UBS Securities said the seasonally adjusted annual inflation rate had come down to 3.5 percent, a welcome drop for Chinese policy makers and consumers.

周三发布的数据同样显示,中国的膨胀已有舒缓,10月份物价同比增长了5.5%。瑞银证券称周期性变动的年膨胀率已经下降到3.5%,对中国的政策制定者和消费者来说都是值得高兴的。

![]()

本文由自动聚合程序取自网络,内容和观点不代表数字时代立场